In the cycle of analytics “Beneficiaries of War”, we write about those sectors of the economy and strata of the Russian population that have become beneficiaries as a result of the war and its consequences (sanctions, mobilization, transformations of budgetary and economic policies, etc.).

The Russian agricultural sector in 2022 became the beneficiary of the war, since Russia is the largest supplier of food to the global market, no sanctions were imposed against farmers, and the jump in grain prices after Ukraine dropped out of world supplies allowed Russian suppliers to monetize the price environment.

Agriculture in 2022 has become one of the most dynamically developing sectors of the Russian economy.

- Agricultural output in Russia increased by 10.2% YoY (at comparable prices1[1]) after declining by 0.4% in 2021. Including crop production, where growth amounted to 15.9% (after a decrease of 0.7% in 2021), in livestock – 2.4% (in 2021, the dynamics was zero).

- Agricultural value added increased by 6.6% YoY, after declining by 0.8% in 2021. Despite the fact that Russia’s GDP at the end of 2022 decreased by 2.1%.

- The share of profitable farms in the agro-industrial complex was more than 90% against 86% in 2021.

- Export of agricultural products from Russia increased by 12% and amounted to an estimated $40 billion, including grain exports – $13 billion (against $11 billion in 2021)

Separately, we should consider the situation with the export of grain, which accounts for a third of Russian agricultural exports: here the war played the most significant role.

To begin with, let us look at the volume of exports and the share of Ukraine and Russia in the world supply of grain: both countries are major market players and, of course, military operations on the territory of Ukraine and the consequences associated with this could not but have an impact on the world market, namely on supply volumes and prices.

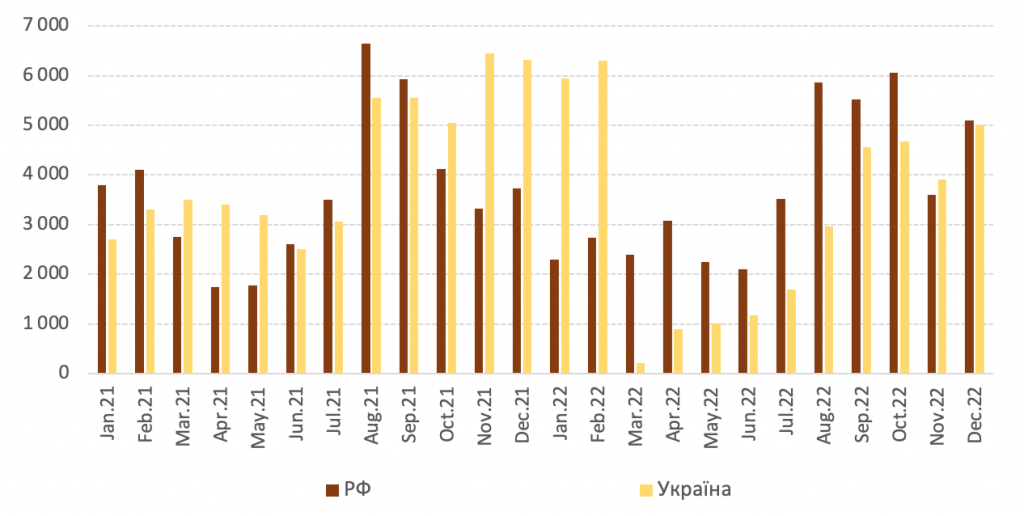

So, while Ukraine was forced to reduce grain supplies, Russia even slightly increased its export volumes in 2022 in physical terms (as can be seen from the Table above and the chart below)

Export of grain from Ukraine and the Russian Federation, 2021-2022 (million tons/month).

We will remind that Ukraine lost part of its crop due to the occupation of territories by Russia with the subsequent export of grain stocks from Ukrainian warehouses to the territory of the Russian Federation[2], part of the crop was destroyed due to fires in the fields, large volumes of grain were blocked in mined Ukrainian ports (at the end of June 2022 – up to 18.5 million tons of grain).

Before the war[3], Ukraine exported 70% of agricultural products by sea. Only after the signing of the Istanbul agreements in the summer of 2022, Ukraine restored approximately pre-war grain exports – 4-5 million tons (September-December 2022).

At the same time, Russia continued to supply grain in approximately usual volumes, and at the end of the year, grain exports in tons even increased by 3.5% to 44.5 million tons. (UIF estimates based on open source data).

But the main thing is not the physical volumes, but the cost and, accordingly, the export earnings of Russian manufacturers.

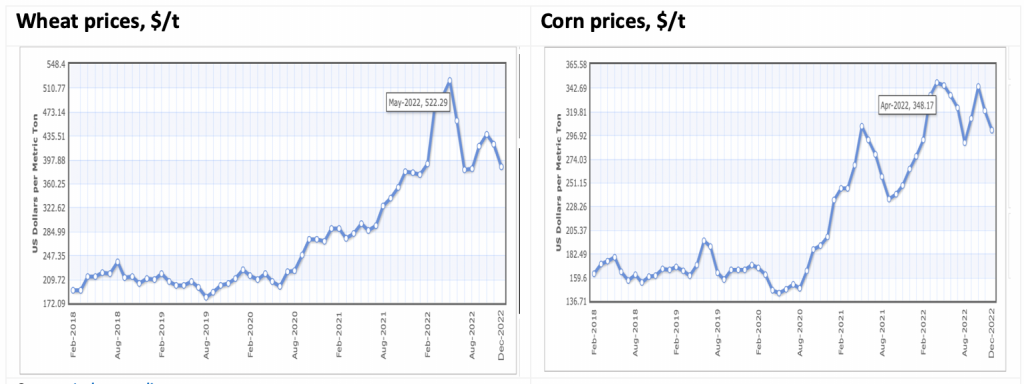

The loss of Ukrainian grain from the world market has led to a reduction in supply and a sharp increase in prices, as can be seen from the charts below.

For Russian farmers, this has become an additional bonus. In monetary terms, the volume of exports of Russian grain in 2022 increased by 15% to $13 billion (data from the Ministry of Agriculture of the Russian Federation).

The volumes of Russian deliveries, and, accordingly, the benefits of Russian farmers could be even greater if it were not for the state policy of the Russian Federation, namely, export duties and quotas, the use of which ensures manual regulation of the sector (price retention).

A few days before the start of a full-scale invasion of Ukraine, quotas were introduced in Russia that limited the supply of grain for export. This was done in order to prevent an increase in food prices within the country, including for such a socially significant product as bread.

In addition to quotas, there are export duties, which also negatively affect the profitability of farmers and make exports unreasonable when the price reaches a certain level. According to market experts, since the launch of duties, more than 350 billion rubles have been withdrawn from farmers, and only 20 billion rubles have been returned in the form of subsidies. Since March 1, 2023, export duties have been further increased.

In addition, there were fears of Russian grain importers about secondary sanctions, difficulties with the charter of ships, delays in the supply of grain carriers, and an increase in transportation tariffs.

These three factors – quotas, duties and problems with logistics – held back the supply volumes and forced farmers to accumulate grain in storage facilities, and these are additional storage costs, additional risks associated with a possible loss of grain quality, with a lack of storage capacity and, accordingly, a reduction factor of producers’ profits.

Considering the record harvest and ongoing logistical difficulties, grain stocks in the Russian Federation as on January 1, 2023 amounted to 35.4 million tons, which is 44% more than a year earlier, and, according to Russian analysts, will amount to 26 million tons at the end of July 2023.

Thus, we can see two trends opposite in their effect:

- volumes and incomes in the grain segment are growing. In 2022, Russia had a record grain harvest – 154 million tons. According to the official forecasts of the Russian authorities, grain exports in January-June 2023 will amount to 30 million tons, or about 5 million tons per month, which is 2 times more than in January-June 2023. Moderate devaluation of the ruble (if regulators take this step to equalize federal budget indicators) could become an additional factor in increasing export revenues.

- the profitability of Russian farmers is reduced due to quotas, storage costs, export duties, high prices for consumables and low domestic prices. In open sources, there are estimates by Russian analysts, according to which the margins of wheat producers may decrease by 1.6 times and 3 times compared to the 2020/21 season.

As for the export of other types of products:

- Deliveries of oil and fat products from Russia increased by 26% in 2022 (in value terms)

- Meat and dairy products – by 16% (data from the Deputy Minister of Agriculture of the Russian Federation).

- Poultry meat exports increased by 16% in volume terms and by 51% in value terms.

- Exports of vegetable oils increased by 2% by 2021. While supplies of sunflower oil have declined, soybean, rapeseed and linseed oils have recorded growth of 12-29% YoY (according to the director of the Oil and Fat Union).

- Export duties on wheat stimulated the growth of processing and export of flour from Russia. Estimated supplies of flour increased 3.5 times in volume terms and almost 4 times in value terms. At the same time, the prospects for this direction remain rather uncertain due to the predicted reduction in the global flour market (it is more profitable for countries to produce it on their own).

China was the largest importer of Russian agricultural products and food products in 2022: physical deliveries to China grew by 36% YoY, in value terms by 44%. Exports to Turkey, Belarus, Kazakhstan, Kyrgyzstan, Armenia, Azerbaijan, Georgia, the United Arab Emirates, Saudi Arabia and other so-called “friendly” countries have grown significantly.

The Russian agricultural sector has really found itself in an advantageous position, because for reasons of humanity, no one will impose sanctions on food supplies to the world market in order to prevent the risk of starvation in poor countries, for which the developed Western world takes responsibility in any case.

It can be said that in the absence of Western sanctions, the Russian authorities decided to fill this gap by imposing domestic sanctions in the form of quotas and duties.

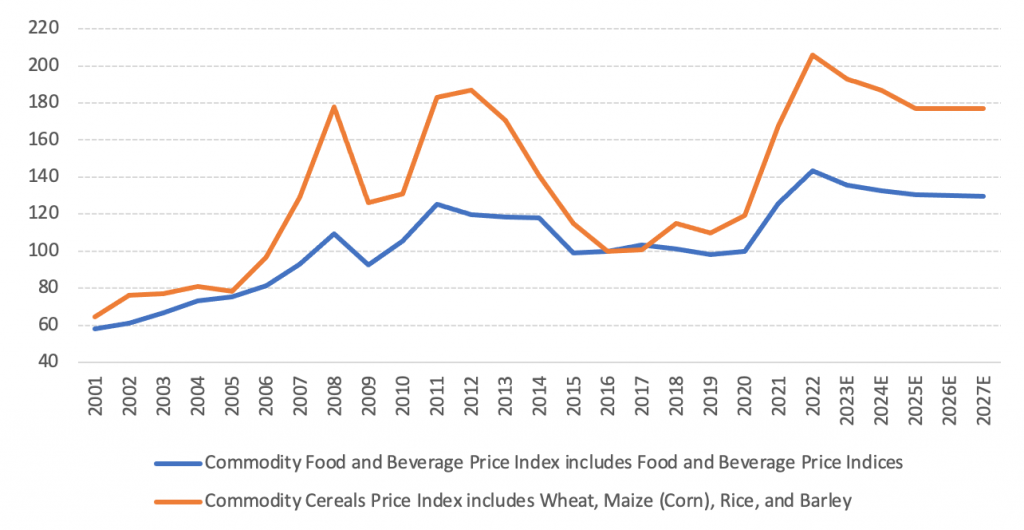

At the same time, prices for agricultural products and food in the world were growing, which was a consequence of the trends of 2021 – rising prices for gas, raw materials, fertilizers. And according to IMF forecasts, they will remain relatively high over the next few years.

Dynamics of world indices for grains and foodstuffs

It is likely that the global crisis and recession, on the verge of which the world has been teetering since 2022, will change the demand for food in the world, and prices will go down. However, the picture looks rather positive so far (from the point of view of agricultural suppliers).

The world grain market may be affected by new agreements under the Black Sea Grain Agreement, according to which Ukraine exports products through the “green corridors”. The July Agreements expire March 18, 2023. However, the negotiation process is still underway, and it is premature to give any assessments. The possible visit of Xi Jinping to Moscow on around the 20th of March and its impact on the outcome of the deal should not be discounted.

It should be noted that the participants in the Russian agricultural sector themselves are not too optimistic about their prospects in 2023, and they say that low domestic prices (below accumulated inflation), the actions of the authorities to apply export quotas and duties, problems with logistics do not allow to monetize record harvests. Domestic consumption of meat and dairy products is constrained by inflation and a reduction in real disposable incomes of the population, that is, a contraction in effective demand.

Additional factors hindering the growth of the Russian agricultural sector could be:

- Strengthening sanctions and restrictions on the supply of imported agricultural machinery to Russia.

- Sanctions against imported seed stock, genetic material for animal husbandry, genetic hatching eggs, animal medicines. For reference: Russia depends on medicines for animals by 70%, genetic hatching eggs by 15-20%, seed fund by an average of 40-55% for various crops, 98-99% for sugar beet, 80% for potatoes, by 50-70% for sunflower, corn, barley and rapeseed.

[1] Deflator index in agriculture amounted to 7% 2022/2021

[2] According to NASA, Russia harvested about 6 million tons of grain in the occupied territories of Ukraine, plus more than 500 thousand tons of grain were taken out of storage. In total, grain worth at least $1 billion was stolen.

[3] This refers to the full-scale invasion of the Russian Federation into Ukraine on February 24, 2022