Gazprom achieved positive financial results from its operations in 2022. This is reflected in the unchanged EBITDA. Despite a decline in exports to Europe, the company even had an increase in revenues due to record high prices. By 2023, however, the situation is going to be radically different. Prices have already returned to normal as Europe confidently turns away from Russian gas and reduces its exports.

Gazprom’s exports to Europe in 2023 are expected to be worth EUR 8-11.5 billion, compared with EUR 40 billion in 2022, based on the baseline scenarios for prices and volumes. As a result, Gazprom’s revenues could fall by about 30 billion euros – 2.58 trillion rubles (at the forecast average annual euro exchange rate of 86 rubles). Losses could exceed previous years’ operating profits. Therefore, the company may end the year on the edge of profitability.

To alleviate the situation, the Russian authorities may resort to a gradual increase in domestic gas prices and possibly a devaluation of the ruble, which could increase ruble revenues from exports denominated in freely convertible currencies.

The network began discussing the published data of Gazprom’s financial results for 2021-2022. It drew attention to the fact that the company has reduced its profits and the amount of available cash. Some commentators even point out that Gazprom has suffered a loss of one trillion rubles. However, even a cursory analysis of the data points to a number of facts: EBITDA has been virtually flat for the past two years. There has been a one-off increase in the severance tax (natural resources extraction tax). We also need to focus on the trends that affected the financial results in 2022 but did not manifest themselves sharply but will be evident next year.

Does Gazprom’s financial report for 2022 really reflect losses?

The unchanged EBITDA (an indicator that reflects earnings before interest, taxes, depreciation and amortisation) actually reflects the company’s normal operating results (looking ahead, these results are driven by record high gas prices, which are speculative in nature, offset gas sales volumes and will deteriorate significantly next year).

In turn, a one-off additional payment of the Natural Resources Extraction Tax (NRET, 1,248) explains the flat EBITDA and the decline in profit and cash. For the period from 1 September to 30 November 2022, the State Duma passed a law imposing an additional tax of RUB 416 billion on Gazprom’s revenues. The additional tax, which will total RUB 1,248 billion, is based on the logic of high export gas prices. Beginning on 1 January 2023, Gazprom will be required to pay a monthly surcharge of RUB 50 billion, which will continue until the end of 2025.

The changes in the tax burden are further evidence of the problems with the Russian budget. The authorities are trying to fill it with additional fees from companies. However, as Gazprom’s real problems are yet to come, it is unclear whether such taxes will be collected (the Russian Finance Ministry estimates the amount of taxes to be collected on Gazprom’s gas production, including the RUB 50 billion surcharge, at RUB 628.3 billion per month in 2023, RUB 699.9 billion in 2024 and RUB 749.6 billion in 2025).

Factors driving the normal financial performance of Gazprom in 2022

It is not very relevant to assess Gazprom’s financial performance in 2022 and 2021 alone. The market conditions were very different. And in 2023 the situation is and will be completely different, which will have an impact on the picture of the company’s financial statements.

The Russian authorities have resorted to energy blackmail by cutting gas supplies under false pretences since the EU began discussing and imposing sanctions on Russia for its full-scale invasion of Ukraine. On the one hand, this has reduced the company’s revenue base. On the other hand, however, the reduction in gas supplies had the effect of exerting additional pressure on the markets, with a significant increase in gas prices in Europe. At the same time, prices were already high at the beginning of 2022. This was because the Kremlin started to reduce supplies to Europe in 2021, creating an energy crisis in order to push through the accelerated commissioning of the Nord Stream 2 gas pipeline. Thus, the volume of natural gas delivered by pipeline totalled 153.4 bcm in 2021 and 67.4 bcm in 2022.

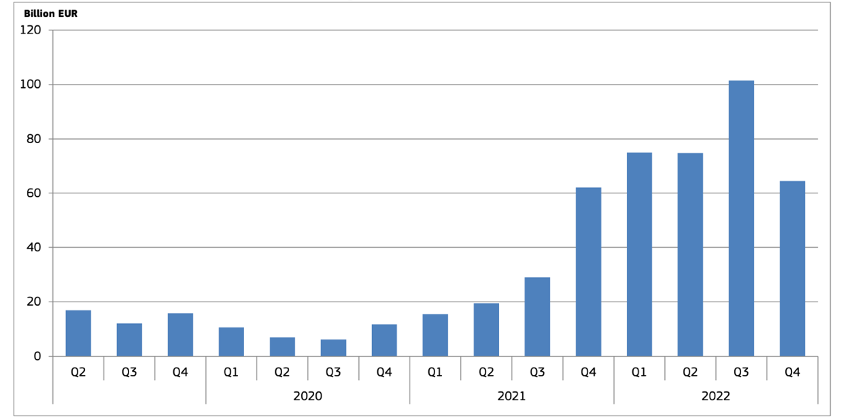

Natural Gas Spot Price Dynamics on the TTF Exchange in 2020-2023

The record price increase compensated for the decrease in physical sales volumes, and Gazprom’s total revenues did not decrease but increased. Overall, EU spending on gas imports to the EU in 2022 was 2.5 times higher than in the previous year.

Estimated quarterly extra-EU gas import bill, billion euro

What are the prospects for Gazprom’s financial results in 2023?

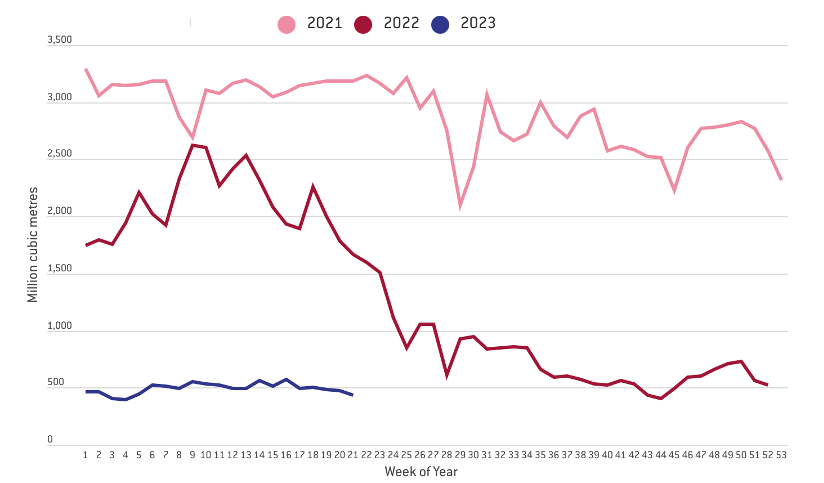

Europe responded to gas blackmail by diversifying its supplies at an unexpected speed. In fact, the EU has accelerated the reduction of Russian gas consumption by increasing supplies from other regions. For example, actual Russian pipeline gas deliveries to Europe in the first 21 weeks of 2023 totalled only 10.3 bcm. This is only 15.7% of the deliveries in the same period of 2021 and 23.4% of the deliveries in the same period of 2022.

Dynamics of Russian pipeline gas supplies to Europe in 2021-2023, by week

With the EU gas supply problem solved and Gazprom’s sales volumes reduced, prices in Europe also fell, even returning to pre-crisis levels: in May 2023, the price fell to €25/MWh, the lowest since end-May 2021. As a result, Gazprom’s financial performance in 2023 will be fundamentally different and significantly worse.

The actual financial result for 2023 will depend on the price environment, the policy of the European Union towards Russian gas and thus the level of deliveries, and the actual reduction in production, as the production tax on piped gas is determined by the actual production level, not by exports (and the actual reduction will be determined by the potential of the domestic market to use gas not supplied abroad, but these opportunities are significantly limited, and in the meantime, domestic market prices are significantly lower than export prices).

The authors of a study consider several scenarios for Russian gas supplies to the EU and the price environment in 2023. Supply levels: low (11.31 bcm – Turkish Stream second line only), base (20.35 bcm – Turkish Stream and Ukrainian transit) and high (27.46 bcm). Average price scenarios: 35, 50 and 100 EUR/MWh.

Thus, in 2023, a range of EUR 4.47-31 billion is projected for the cost of imported Russian gas delivered by pipeline. The projected cost of gas is EUR 8-11.5 billion, considering the minimum and base price scenarios and the baseline assumption of supply volumes. Compare this with the total cost of imported Russian gas in 2022, which is estimated at EUR 40 billion. This means that Gazprom’s revenues could be reduced by about EUR 30 billion. This is equivalent to RUB 2.58 trillion. Taking into account forecasts that the average annual exchange rate of the euro will be RUB 86 (although a slight devaluation in the second half of the year and a slightly higher euro is possible).

Unfortunately, it is not possible to build a financial model of Gazprom on the basis of publicly available data and therefore to estimate precisely the change in costs and tax payments with such a reduction in gas exports to Europe. Nevertheless, it is possible that the operating profit of the previous two years will be exceeded by the drop in export revenues in 2023 under the baseline scenario. It is, therefore, possible that the company will be on the brink of profitability at the end of the year. However, it is assumed that the Russian authorities do not consider the unprofitability of the company to be attractive. It is possible that the Russian authorities will have recourse to a gradual increase in domestic gas prices and possibly a devaluation of the ruble as a means of alleviating the situation, which could increase ruble revenues from exports in freely convertible currencies.